Stockyfly stands out as a premier and highly sought-after platform, offering an intuitive strategy builder for algorithmic trading in NIFTY, BANKNIFTY, and FINNIFTY. Users can effortlessly craft their own trading strategies, conduct backtests in real market conditions, and seamlessly connect their accounts with brokerages like Zerodha, Fyers, and Angel for automatic trade execution based on predefined BUY and SELL criteria. In the case of options trading, the application selects CE for BUY conditions and PE for SELL conditions.

Benefits:

Users can enjoy a hassle-free trading experience without the need to constantly monitor charts or trade throughout the day. Each strategy allows users to specify lot sizes, stop-loss levels, and target points, with trades automatically closing once either the stop-loss or target is reached. Users have the flexibility to set their desired risk-to-reward ratios, choosing from options of 1:1, 1:2, 1:3, and beyond, depending on their preferences. Plus, as a cloud-based platform, there’s no need for any additional software installations.

Strategy Builder:

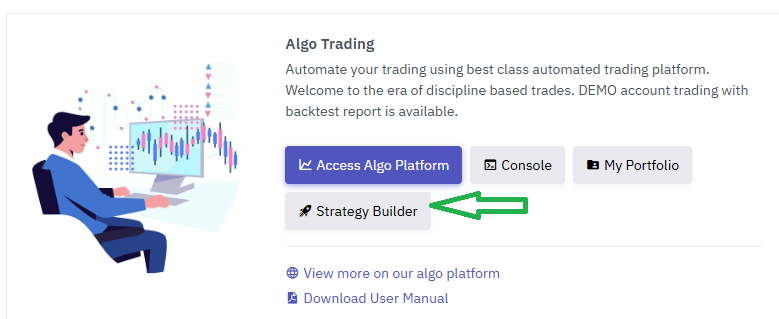

Here is the explanation on how strategy builder works. User can login in stockyfly.com using google id and from dashboard can click on “Strategy Builder” to access the Strategy Builder.

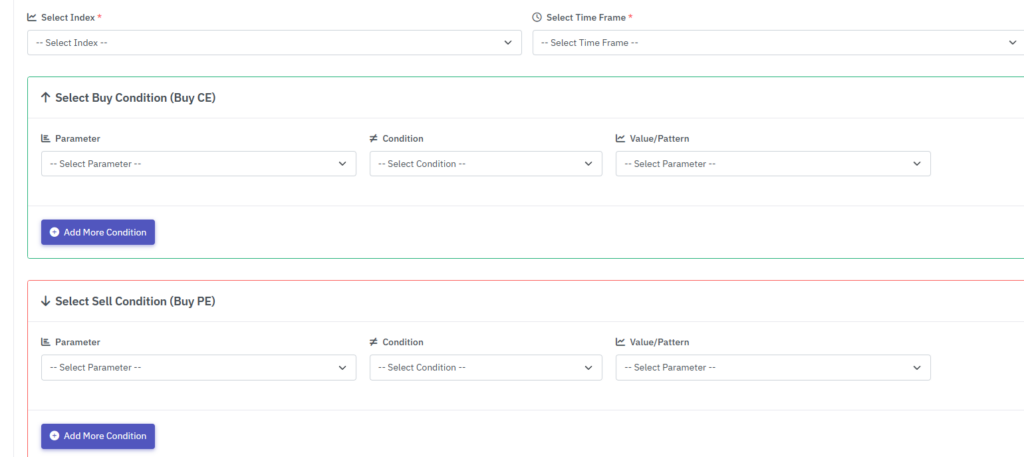

Strategy Builder page will open with various options as shown below;

Let’s got hrough the options one by one;

Select Index: NIFTY/BANKNIFTY/FINNIFTY

Select Time Frame: 5 MIN/15 MIN

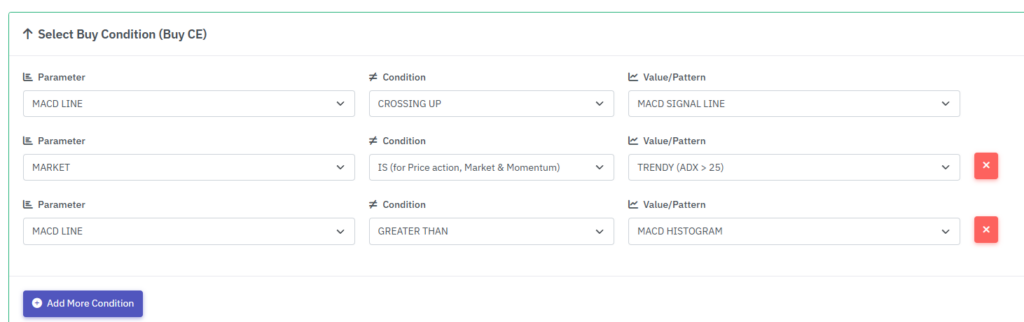

Buy Condition & Sell Condition : Here user can define BUY and SELL conditions. Here is an example;

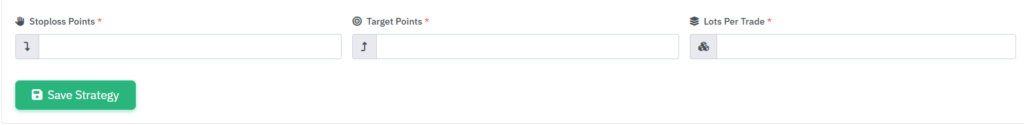

Once you define BUY and SELL conditions, it will ask for Stoploss Points, Target Points and number of LOTs per trade.

For example: SL: 20 Points, Target: 40 Points and Lot Size:1

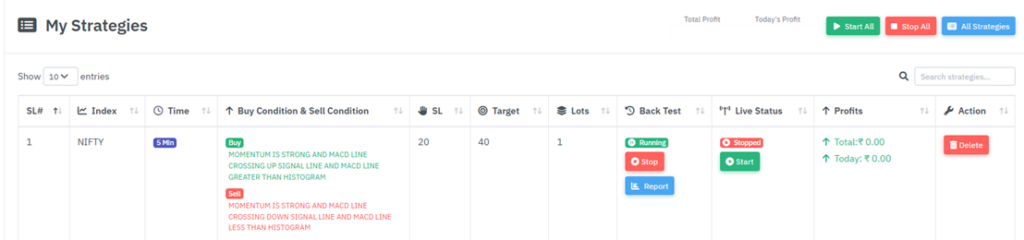

Finally save the strategy. Once saved, the created strategy will appear in a list.

Options such as “Start All” allow you to initiate all strategies at once, while “Stop All” enables you to halt them simultaneously. After creating a strategy, trading takes place during Market Trading time for backtesting purposes (this does not involve a live trading account). To evaluate the performance of your strategy, click on the “Report” option located under each strategy. Once you’re satisfied with the results and confident in your strategy’s effectiveness, simply select the “Start Live” option to begin executing trades in your actual trading account.

Supported Indicators & Price Action Patterns:

EMA 20,50,100,200

MACD LINE, SIGNAL LINE, HISTOGRAM

CMP (Current Market Price)

ADX

Consolidation Breakout, Ascending channel Breakout, Descending channel breakout, Inverse Head & Shoulder Breakout, Head & Shoulder Breakout

Important Points:

- Trades get started executed from 9:30 AM and all trades got auto closed max at 9:28 PM

- When a trade is active, no additional trades from other strategies will run simultaneously. For instance, if a trade is initiated by one of your strategies, any other strategies will be automatically paused until the current trade is concluded. This feature is designed to enhance risk management.

Support & Contact:

For any assistance can reach Whatsapp: 8480314479 or Telegram: @mausumip