Best Demat Account Providers in India 2026

Hey there, fellow investors and market enthusiasts! Welcome to your definitive guide to navigating the exhilarating world of Demat accounts in India for 2026. If you’re looking to dive into the stock market, manage your investments, or simply secure your financial future, choosing the right Demat account provider is arguably the most crucial first step. And let me tell you, with the pace at which the Indian market is evolving, 2026 is set to be an even more exciting year for investors, offering more choices, advanced technology, and competitive pricing than ever before.

Gone are the days when investing was just for the elite few. Today, thanks to digital transformation and innovative brokers, almost anyone can participate in India’s booming economy. But with so many options out there, how do you pick the one that’s perfect for you? That’s exactly what we’re here to unravel.

In this comprehensive guide, we’ll cut through the noise, scrutinize the top players, and help you understand what truly matters when selecting your Demat partner. Whether you’re a seasoned trader looking for advanced tools, a long-term investor seeking robust research, or a complete beginner just dipping your toes into the market, we’ve got you covered. We’ll break down the pros and cons, highlight key features, and give you a clear “best for” recommendation for each provider.

So, buckle up! Let’s find you the ideal Demat account that aligns with your investment style, budget, and future aspirations in the Indian stock market.

Quick Comparison Table: India’s Top Demat Account Providers 2026

Before we dive deep into individual reviews, here’s a snapshot to give you a quick overview of how the top contenders stack up against each other. This table will help you compare key features at a glance, allowing you to quickly identify providers that might fit your initial criteria.

| Product | Account Opening Fee | Annual Maintenance Charges (AMC) | Equity Delivery Brokerage | Key Feature | Best For |

|---|---|---|---|---|---|

| Groww | Free | ₹0 – ₹300 (varies) | Zero to minimal | User-friendly, largest customer base | Beginner investors, retail traders seeking simplicity and low costs |

| Zerodha | Variable | ₹0 | ₹20 per trade (Intraday/F&O generally; Delivery often free) | Kite platform, Varsity education | Advanced traders and investors comfortable with technology-driven platforms |

| Angel One | Varies | ₹400-₹800 | ₹20 per trade | Extensive offline network, advisory | Investors seeking digital convenience and offline support with personalized advisory |

| Upstox | Free | ₹0 (1st year free), then variable | ₹20 per trade | Beginner-friendly, zero AMC (1st yr) | Beginners and retail investors seeking low-cost, no-frills trading platforms |

| ICICI Direct | Variable | ₹250-₹400 | Variable | 3-in-1 integrated account | Retail investors seeking trusted, full-service brokerage with banking integration |

| HDFC Securities | Variable | ₹300-₹500 | Variable | Comprehensive research, wealth management | Investors seeking full-service brokerage with research, advisory, and wealth management |

| Pocketful | Free | ₹0 (1st year free), then variable | ₹0 on equity delivery | Zero brokerage, lowest MTF rates, API access | Cost-conscious traders, long-term equity investors seeking zero fees and advanced algorithmic tools |

A Deeper Dive

Now, let’s roll up our sleeves and get into the nitty-gritty of each Demat account provider. We’ll explore their offerings, weigh their strengths and weaknesses, and help you understand which one might be your perfect match.

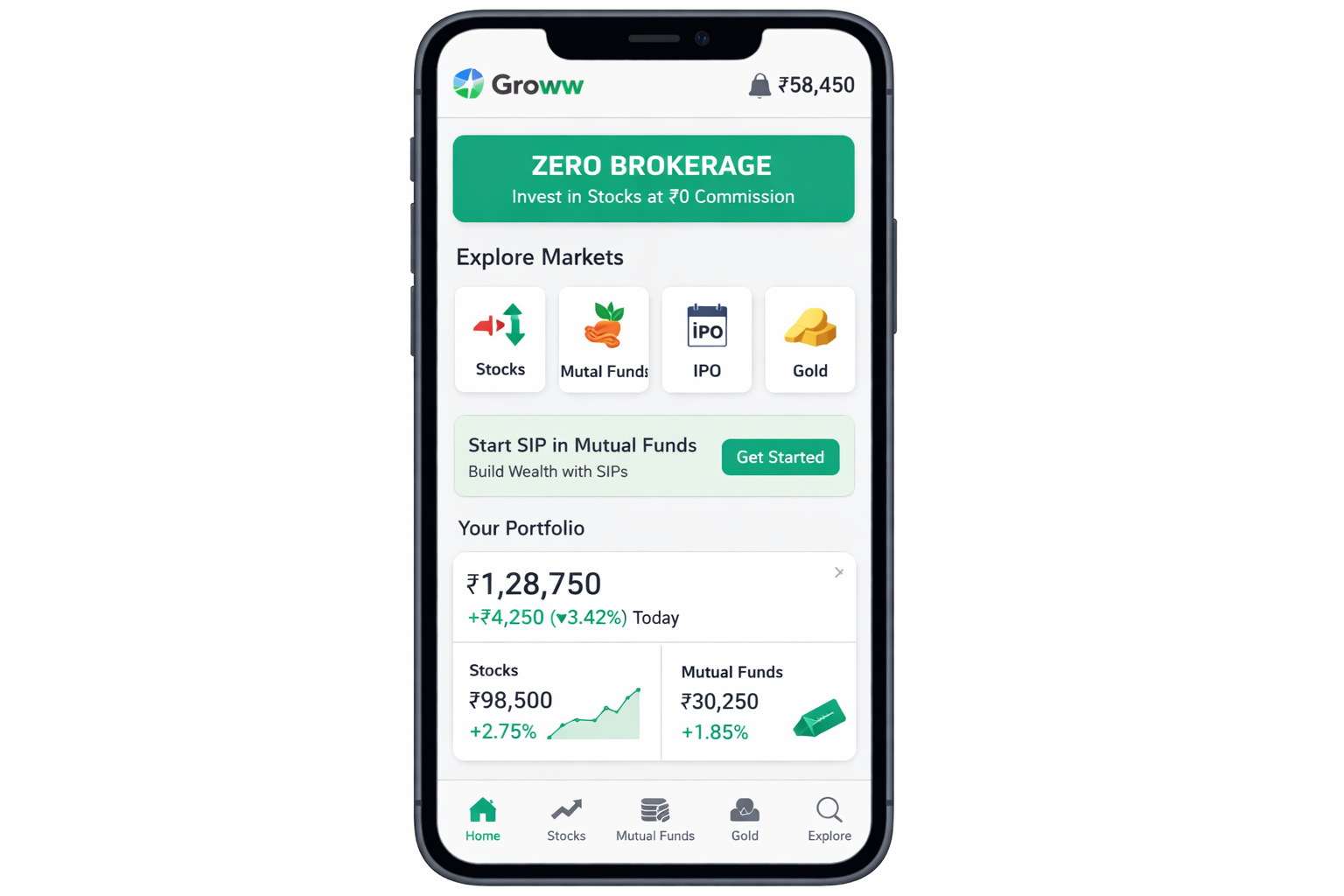

1. Groww

Price: ₹0 – ₹300 annually (AMC varies); Free Demat account opening

Description: Groww has rapidly ascended to become a household name in the Indian investment landscape. It’s a discount broking platform that doubles as a Demat account provider, celebrated for its incredibly user-friendly mobile and web interface. Launched with a clear vision to simplify investing, Groww has managed to attract a massive user base, making it a dominant force, especially among new-age investors. Their emphasis on a clean, intuitive design and a straightforward fee structure has resonated with millions, positioning them as a leader in accessible digital investing.

Key Features:

- Massive User Base: With over 1.21+ crore NSE clients, Groww boasts the largest customer base, a testament to its widespread appeal and trust among Indian investors.

- Unmatched Simplicity: The platform is designed from the ground up to be easy to use, making it ideal for individuals who are new to the stock market or prefer a hassle-free trading experience.

- Low-Cost Trading: Enjoy zero to minimal brokerage charges for equity delivery, significantly reducing the cost burden for long-term investors.

- Evolving Trading Tools: While known for simplicity, Groww also offers increasingly advanced trading platforms and charting tools, continually enhancing its utility for more active traders.

✅ Pros:

- Largest customer base by NSE clients, indicating high reliability and popularity.

- Simple and intuitive interface, perfect for beginners.

- Zero to minimal brokerage charges for equity delivery trades.

- Continuously improving advanced trading platforms and charting tools.

- Seamless experience for mutual fund investments alongside stocks.

❌ Cons:

- Basic research tools compared to comprehensive offerings from full-service brokers.

- Limited offline support network, primarily relying on digital channels.

- Fewer investment advisory services, catering more to self-directed investors.

Best for: Beginner investors and retail traders seeking simplicity, a user-friendly interface, and low costs for their investment journey. If you’re just starting out or prefer a straightforward approach without complicated features or high fees, Groww is an excellent choice.

2. Zerodha

Price: ₹20 per trade; ₹0 AMC (no annual maintenance charges)

Description: Zerodha, established in 2010, is a true pioneer in the Indian discount broking space. It revolutionized the industry with its innovative flat brokerage model, democratizing trading for millions. Known for its robust technology and focus on self-directed trading, Zerodha has built a formidable reputation around its flagship Kite trading platform. It consistently ranks high for its advanced features, transparent pricing, and commitment to investor education, evidenced by its popular Varsity platform. Despite its advanced offerings, Zerodha prides itself on a lean, technology-first approach.

Key Features:

- Kite Platform: The advanced Kite platform is renowned for its extensive charting and technical analysis tools, offering a professional-grade trading experience.

- Transparent Brokerage: A flat brokerage pricing structure of ₹20 per trade (for intraday and F&O) means you know exactly what you’re paying, with equity delivery often being free.

- High User Ratings: Consistently rated highly (e.g., 4.8 out of 5), reflecting strong user satisfaction with its platform and services.

- Varsity Education: An integrated educational platform, Varsity, provides in-depth modules on stock market concepts, making it invaluable for learning and skill development.

- Second-Largest Customer Base: With over 68.5+ lakh NSE clients, it holds a significant market share, demonstrating its trust and reliability among serious traders.

✅ Pros:

- Industry-leading Kite platform with extensive charting, technical analysis, and customization options.

- Transparent, flat brokerage pricing model that appeals to active traders.

- High ratings and positive reputation within the trading community.

- Integrated educational platform (Varsity) offers comprehensive market knowledge.

- Strong focus on technological innovation and platform stability.

❌ Cons:

- Can have a steeper learning curve for absolute beginners compared to highly simplified platforms.

- Primarily online-based support, without an extensive physical branch network for in-person assistance.

Best for: Advanced traders and investors who are comfortable with technology-driven platforms, appreciate sophisticated charting and analysis tools, and are keen on self-learning. If you’re serious about active trading and want a powerful platform with transparent costs, Zerodha is a top contender. For those interested in advanced strategies, Zerodha’s platform also provides excellent support for integrating algorithmic trading strategies, which can be further explored with resources on algo trading platforms.

3. Angel One

Price: ₹20 per trade; AMC ₹400-₹800; Account opening fee varies

Description: Angel One, established way back in 1996, is a well-established full-service broker that has successfully transitioned into the digital age. It offers a comprehensive suite of services encompassing trading, investing, and wealth management. What sets Angel One apart is its hybrid model, which perfectly blends digital convenience with a significant physical presence. This allows them to cater to a diverse clientele, from digital-savvy traders to those who prefer personalized, offline support and advisory services.

Key Features:

- Third-Largest Customer Base: With over 67.5+ lakh NSE clients, Angel One has a substantial and growing presence in the market.

- Extensive Offline Network: Boasts a vast offline branch network across approximately 900 Indian cities, providing accessible in-person support and advisory.

- Comprehensive Investment Products: Offers a wide array of investment avenues, including equities, commodities, derivatives, mutual funds, and more.

- Investment Advisory Services: Provides personalized investment advice and wealth management solutions, a key differentiator from pure discount brokers.

- Margin Trading Facilities: Offers margin trading facilities, allowing eligible investors to leverage their investments.

✅ Pros:

- Combines digital convenience with the assurance of an extensive offline support network.

- Offers a broad spectrum of investment products and services under one roof.

- Provides personalized investment advisory and wealth management, valuable for holistic financial planning.

- Long-standing reputation and trust built over decades in the industry.

❌ Cons:

- Higher annual maintenance charges (AMC) compared to many discount brokers.

- More complex fee structure with various charges beyond just brokerage.

Best for: Investors seeking both digital convenience and the option of offline support with personalized advisory services. If you value a full-service experience, access to expert advice, and a wide range of products, and don’t mind slightly higher charges for these benefits, Angel One is an excellent choice.

4. Upstox

Price: ₹20 per trade; Free Demat account (zero AMC for 1st year)

Description: Upstox is another prominent discount broker that has gained considerable traction, especially among beginners and retail investors. It offers a straightforward platform for trading across equities, commodities, and mutual funds via its mobile and web applications. Upstox positions itself as an accessible and affordable option, making it easy for new investors to enter the market. Its clear pricing structure and focus on essential trading features make it a strong contender for those seeking a no-frills yet effective brokerage solution.

Key Features:

- Beginner-Friendly: Widely recommended for beginners due to its intuitive interface and simplified trading process.

- Attractive AMC Offer: Zero annual maintenance charges for the first year, making it cost-effective for new users to start.

- Solid User Rating: A respectable rating of 4.3 out of 5 indicates good user satisfaction.

- Multi-Asset Trading: Provides seamless trading access across equities, commodities, and mutual funds from a single platform.

- Diverse Customer Support: Offers phone, email, and chat customer support channels for assistance.

✅ Pros:

- Highly recommended for beginners due to its ease of use and simple navigation.

- Zero annual maintenance charges for the first year significantly reduce initial costs.

- Good customer support through multiple channels.

- Access to multiple asset classes (equities, commodities, mutual funds).

❌ Cons:

- Basic research tools and limited in-depth market analysis compared to full-service brokers.

- Limited offline support infrastructure, primarily an online-focused operation.

Best for: Beginners and retail investors seeking a low-cost, easy-to-use, and no-frills trading platform. If you want a straightforward entry into the stock market with minimal initial costs and a clean interface, Upstox is a very suitable option.

5. ICICI Direct

Price: AMC ₹250-₹400; Variable account opening and brokerage fees

Description: ICICI Direct is a powerhouse in the full-service brokerage segment, backed by the immense infrastructure and trust of ICICI Bank. Its standout feature is the integrated 3-in-1 account, which seamlessly links your savings bank account, trading account, and Demat account. This integration eliminates the hassle of fund transfers between different entities, offering unparalleled convenience for ICICI Bank customers. Beyond convenience, ICICI Direct provides a comprehensive suite of services, including in-depth research and advisory, catering to investors who value reliability and a broad range of offerings from a trusted brand.

Key Features:

- Massive Customer Base: Serves over 7.5+ million active customers over the years, signifying extensive reach and trust.

- Integrated 3-in-1 Account: The seamless integration of savings, trading, and Demat accounts simplifies fund transfers and overall portfolio management.

- Comprehensive Research: Offers extensive research reports, market insights, and investment advisory services to guide investment decisions.

- Trusted Brand: Backed by the robust infrastructure and strong reputation of ICICI Bank, providing a sense of security and reliability.

- User-Friendly Website: Known for its user-friendly website, making it accessible for retail investors despite its extensive features.

✅ Pros:

- Unmatched convenience with the 3-in-1 integrated account, especially for existing ICICI Bank customers.

- Robust research reports and investment advisory services aid informed decision-making.

- The strong backing of ICICI Bank instills high confidence and trust.

- A wide range of investment products and services suitable for various investor needs.

❌ Cons:

- Higher annual maintenance charges compared to discount brokers.

- Fee structure can be more complex and may involve multiple charges beyond basic brokerage.

- Brokerage fees are generally higher and variable, depending on the segment and trading volume.

Best for: Retail investors who are existing ICICI Bank customers or those seeking a highly trusted, full-service brokerage with seamless banking integration. If you prioritize convenience, comprehensive research, and the security of a major banking institution, ICICI Direct is an excellent choice.

6. HDFC Securities

Price: Brokerage varies; AMC ₹300-₹500 annually

Description: HDFC Securities, a subsidiary of HDFC Bank, stands as another pillar in the full-service brokerage domain. Similar to ICICI Direct, it leverages its banking parentage to offer a secure and integrated investing experience. HDFC Securities caters to investors who demand more than just basic trading—they seek wealth management, expert investment advice, and access to in-depth market research. With multiple trading platforms and a strong customer support network, it aims to provide a premium service to its clientele.

Key Features:

- Multiple Trading Platforms: Offers a variety of trading platforms, including desktop software and mobile apps, to suit different user preferences.

- Daily Research Reports: Provides daily sector-wise research reports and insightful market analysis, crucial for fundamental and technical investors.

- Wealth Management & Advisory: Comprehensive wealth management and investment advisory services are available for holistic financial planning.

- Strong Customer Support: Ensures robust customer support through phone, a network of branches, and email, offering multiple avenues for assistance.

- Reputable Banking Backing: The strong backing of HDFC Bank provides inherent trust and reliability.

✅ Pros:

- Offers multiple sophisticated trading platforms for diverse user needs.

- Provides extensive daily research reports and expert insights to guide investments.

- Comprehensive wealth management and investment advisory services.

- Strong and accessible customer support channels, including physical branches.

- Backed by one of India’s most reputable banking institutions, ensuring security.

❌ Cons:

- Higher AMC and brokerage charges compared to discount brokers.

- May be more suitable for active investors with higher trading volumes to justify the costs.

- The platform and its array of services can be overwhelming for absolute beginners.

Best for: Investors seeking a full-service brokerage with strong research capabilities, personalized advisory, and wealth management services. If you’re an active investor, value expert guidance, and prefer the security of a large banking institution, HDFC Securities offers a premium experience.

7. Pocketful

Price: ₹0 brokerage on equity delivery; No account opening or annual maintenance fees (1st year free)

Description: Pocketful is the newest entrant on our list, launched in 2024 by Pace Financial Group. Despite being a new player, it arrives with a strong pedigree, backed by over 30 years of industry expertise from its parent company. Pocketful is quickly making waves by focusing on extreme cost-efficiency and advanced technological offerings, especially for cost-conscious traders and developers. Its standout promise of zero brokerage on equity delivery transactions, coupled with zero account opening and AMC for the first year, positions it as a highly attractive option for new and experienced investors alike.

Key Features:

- Zero Brokerage on Equity Delivery: A major draw for long-term investors, ensuring that holding stocks doesn’t incur unnecessary trading costs.

- Zero Upfront Fees: No account opening or annual maintenance fees for the first year, making it incredibly accessible.

- Lowest MTF Interest Rates: Offers market-leading Margin Trading Facility (MTF) interest rates starting at a remarkably low 5.99%, appealing to traders who use leverage.

- Free Trading Strategy APIs: Provides free trading strategy APIs for algorithm development, a unique offering that caters to quantitative traders and developers looking to build their own systems. For advanced users, resources like https://www.stockyfly.com/api and https://www.stockyfly.com/algo_trading can be invaluable.

- User-Friendly Design: Despite its advanced features, it aims for a user-friendly design, leveraging its parent company’s extensive industry experience.

✅ Pros:

- Absolutely zero brokerage on equity delivery transactions – a huge cost saver.

- No account opening fees and zero AMC for the first year makes it budget-friendly.

- Offers the lowest MTF interest rates in the market, beneficial for leveraged trading.

- Provides free trading strategy APIs, a significant advantage for algo traders and developers.

- Backed by 30+ years of industry expertise from Pace Financial Group, despite being new itself.

❌ Cons:

- Being a very new platform (launched in 2024), it has a limited user base and track record compared to established brokers.

- Limited established reputation and user reviews might be a concern for some investors seeking long-proven reliability.

Best for: Cost-conscious traders and long-term equity investors who prioritize zero fees, particularly on delivery trades, and those interested in advanced trading tools like API access for algorithmic strategies. If you’re an early adopter seeking cutting-edge features and minimal costs, Pocketful is certainly worth exploring. You can learn more about its algo performance and how it stacks up on https://www.stockyfly.com/algo_performance.

What to Consider When Choosing Your Demat Account

Choosing the best Demat account isn’t a one-size-fits-all decision. It’s a personal journey that depends heavily on your investment style, financial goals, and comfort level with technology. To help you make an informed choice, here are the critical factors to consider:

1. Fees and Charges

This is often the first thing people look at, and for good reason. Fees can significantly eat into your returns over time.

- Account Opening Charges: Many brokers now offer free Demat account opening, but some full-service brokers may still charge.

- Annual Maintenance Charges (AMC): This is a yearly fee to maintain your Demat account. Some brokers offer zero AMC, especially for the first year, while others charge a nominal or higher fee depending on the services.

- Brokerage Charges: This is the fee you pay for executing trades.

- Equity Delivery: Many discount brokers offer ₹0 brokerage for equity delivery (buying and holding shares). This is crucial for long-term investors.

- Intraday/F&O/Commodities/Currency: For these segments, discount brokers typically charge a flat fee (e.g., ₹20 per trade), while full-service brokers might charge a percentage-based brokerage (which can be higher for large volumes).

- Other Charges: Look out for transaction charges (STT, SEBI turnover fees, stamp duty), DP charges (for selling shares), payment gateway charges, and call-and-trade charges. A transparent fee structure is always a plus.

2. Trading Platform and User Interface

Your trading platform is your window to the market. Its quality can make or break your trading experience.

- Ease of Use: Is the platform intuitive, especially if you’re a beginner? A clean, uncluttered interface can save you a lot of hassle.

- Features & Tools: Does it offer advanced charting, technical indicators, order types (e.g., GTT, AMO), and real-time data? Advanced traders will need more sophisticated tools.

- Platform Stability & Speed: Crucial for active traders. A laggy platform can lead to missed opportunities or executed trades at unfavorable prices.

- Mobile App: Is the mobile app robust, feature-rich, and easy to use on the go?

- Web/Desktop Platform: Some prefer dedicated desktop software for more extensive features and multiple screen setups.

3. Customer Support

Even the most experienced investors need support sometimes.

- Availability: What are their support hours? 24/7 or specific timings?

- Channels: Do they offer phone, email, chat, or even physical branch support?

- Response Time & Quality: How quickly do they respond, and how effective are their solutions? Read user reviews for insights. Full-service brokers typically excel here with dedicated relationship managers.

4. Research and Advisory Services

This is a key differentiator between full-service and discount brokers.

- Full-Service Brokers: Provide in-depth research reports (fundamental and technical), market outlooks, stock recommendations, and personalized investment advisory. This can be invaluable for investors who need guidance.

- Discount Brokers: Generally offer basic research tools, technical analysis features, and news feeds, but no personalized advice. They cater to self-directed investors. Consider what level of guidance you need.

5. Product Offerings

Ensure the broker supports all the asset classes you plan to invest in.

- Equities (Cash & F&O): Standard for all.

- Commodities & Currencies: Some brokers offer this, others don’t.

- Mutual Funds: Many brokers integrate mutual fund investment.

- IPOs & NCDs: Access to primary market offerings.

- Bonds/ETFs: Expanding investment options.

6. Integration and Banking Facilities

- 3-in-1 Account: Brokers like ICICI Direct and HDFC Securities offer seamless integration with their banking services, simplifying fund transfers and account management. This can be highly convenient if you already bank with them.

- Fund Transfer Options: Check for various options like UPI, Net Banking, IMPS, and RTGS, and if there are any charges for fund transfers.

7. Reliability and Track Record

Especially with newer platforms, considering the background and track record is important.

- Parent Company: Is the broker backed by a reputable financial group (like Pocketful by Pace Financial Group)?

- Market Share: A larger customer base often indicates trust and reliability.

- SEBI/Exchange Compliance: Ensure the broker is well-regulated and compliant with all regulatory requirements.

By carefully evaluating these factors against your personal investment profile, you’ll be well-equipped to choose a Demat account provider that not only meets your current needs but also supports your long-term financial journey in the dynamic Indian market of 2026. For those venturing into more complex trading strategies, understanding the underlying technology, and perhaps even integrating APIs, can provide an edge. You might find resources like https://www.stockyfly.com/algo_platform_user_manual.pdf helpful to understand how these tools work.

FAQ Section: Your Burning Questions Answered

We get it; the world of Demat accounts can throw up a lot of questions. Here are some of the most common ones we encounter, answered to help clarify things for you.

Q1: What is a Demat account, and why do I need one?

A Demat (Dematerialized) account is essentially an electronic account that holds your shares and other securities (like mutual funds, bonds, and ETFs) in a digital format. Just like a bank account holds your money, a Demat account holds your investments. You need one because, in India, it’s mandatory to hold securities in dematerialized form if you want to trade in the stock market. It eliminates the risks associated with physical share certificates (like theft, damage, or forgery) and makes trading much faster and more efficient.

Q2: What’s the difference between a discount broker and a full-service broker?

This is a crucial distinction!

- Discount Brokers (e.g., Groww, Zerodha, Upstox, Pocketful): Focus primarily on providing low-cost trading platforms and execution services. They offer minimal or no research, advisory, or personalized wealth management. Their strength lies in their technology, low fees (especially for equity delivery), and often flat-rate brokerage for other segments. They are ideal for self-directed investors who prefer to do their own research.

- Full-Service Brokers (e.g., Angel One, ICICI Direct, HDFC Securities): Offer a comprehensive suite of services, including trading platforms, in-depth research reports, market analysis, personalized investment advice, wealth management, and often physical branch support. They charge higher brokerage (often percentage-based) and higher AMCs to cover these extensive services. They are better for investors who seek guidance, advisory, and a broader range of products and support.

Q3: Can I have multiple Demat accounts?

Yes, absolutely! There’s no restriction on having multiple Demat accounts with different brokers. Many investors choose to do this for various reasons – perhaps one for long-term investments with zero delivery brokerage, and another with advanced tools for active trading. Or maybe one with a full-service broker for advisory and another with a discount broker for specific low-cost trades. However, remember that each Demat account will typically incur its own Annual Maintenance Charges (AMC) and other associated fees, so be mindful of managing multiple accounts.

Q4: Are my investments safe in a Demat account?

Yes, investments held in a Demat account are very safe. In India, Demat accounts are regulated by SEBI (Securities and Exchange Board of India) and maintained by two depositories: CDSL (Central Depository Services Limited) and NSDL (National Securities Depository Limited). Your broker is merely an intermediary (Depository Participant or DP). The shares are held electronically with these depositories, not directly by the broker. Even if a broker goes out of business, your shares held with the depository remain safe and can be transferred to another Demat account. Robust security measures and strict regulatory oversight further enhance the safety of your holdings.

Q5: What is algorithmic trading, and how can a Demat account support it?

Algorithmic trading, or “algo trading,” involves using computer programs to execute trades automatically based on pre-defined rules, strategies, and market conditions. It leverages technology to analyze market data, identify trading opportunities, and place orders at high speeds, often faster than human traders. Many advanced Demat account providers now offer features that support algo trading. This can include:

- API Access: Brokers like Pocketful offer free trading strategy APIs (Application Programming Interfaces) that allow users to connect their own custom-built algorithms directly to the broker’s trading system.

- Advanced Platform Tools: Some platforms provide robust charting and technical analysis tools that are essential for developing and testing algorithmic strategies.

- Backtesting Capabilities: The ability to test strategies against historical data.

If you’re interested in exploring the fascinating world of automated trading, choosing a broker with strong API support and a tech-first approach is crucial. You can delve deeper into specific tools and services for algo trading by checking out resources like https://www.stockyfly.com/algo_signal_service or general information on https://www.stockyfly.com/algo_trading.

Final Verdict: Your Ideal Demat Account for 2026

Alright, investors, we’ve journeyed through the intricate landscape of India’s best Demat account providers for 2026. By now, you should have a much clearer picture of what each contender brings to the table and, more importantly, what aligns with your unique investment profile.

So, who wins? Well, as you might have gathered, there’s no single “best” Demat account. The ideal choice is the one that best suits you.

- For the Absolute Beginner & Cost-Conscious Long-Term Investor:

Groww stands out with its incredibly user-friendly interface and zero to minimal brokerage on equity delivery. It’s the easiest entry point into the market. A strong newcomer to consider is Pocketful, especially if zero brokerage on delivery and the lowest MTF rates are your top priorities, and you’re comfortable with a new, technologically advanced platform. Upstox also makes an excellent choice for beginners, offering a simple platform and zero AMC for the first year. - For the Advanced Trader & Tech Enthusiast:

Zerodha remains the undisputed king here. Its Kite platform, extensive charting tools, and educational resources make it a powerful choice for serious, self-directed traders. If you’re looking to implement algorithmic strategies or demand robust performance, Zerodha provides the ecosystem, and Pocketful with its free APIs could be a strong supplementary choice. - For the Investor Seeking a Hybrid Model & Advisory:

Angel One strikes a perfect balance between digital convenience and the reassurance of an extensive offline presence and personalized advisory services. If you need expert guidance and a comprehensive suite of products but still want to trade digitally, Angel One delivers. - For the Investor Valuing Banking Integration & Full Service:

If you prioritize the convenience of a 3-in-1 account, comprehensive research, and the unshakeable trust of a major bank, then ICICI Direct and HDFC Securities are your go-to options. They offer a premium, secure, and guided investment experience, albeit with higher costs.

The Indian stock market in 2026 promises growth, innovation, and myriad opportunities. Your Demat account is your gateway to participate in this journey. Take your time, weigh your options against your personal needs, and choose the provider that empowers you to invest smarter, grow wealthier, and achieve your financial aspirations.

Happy investing!