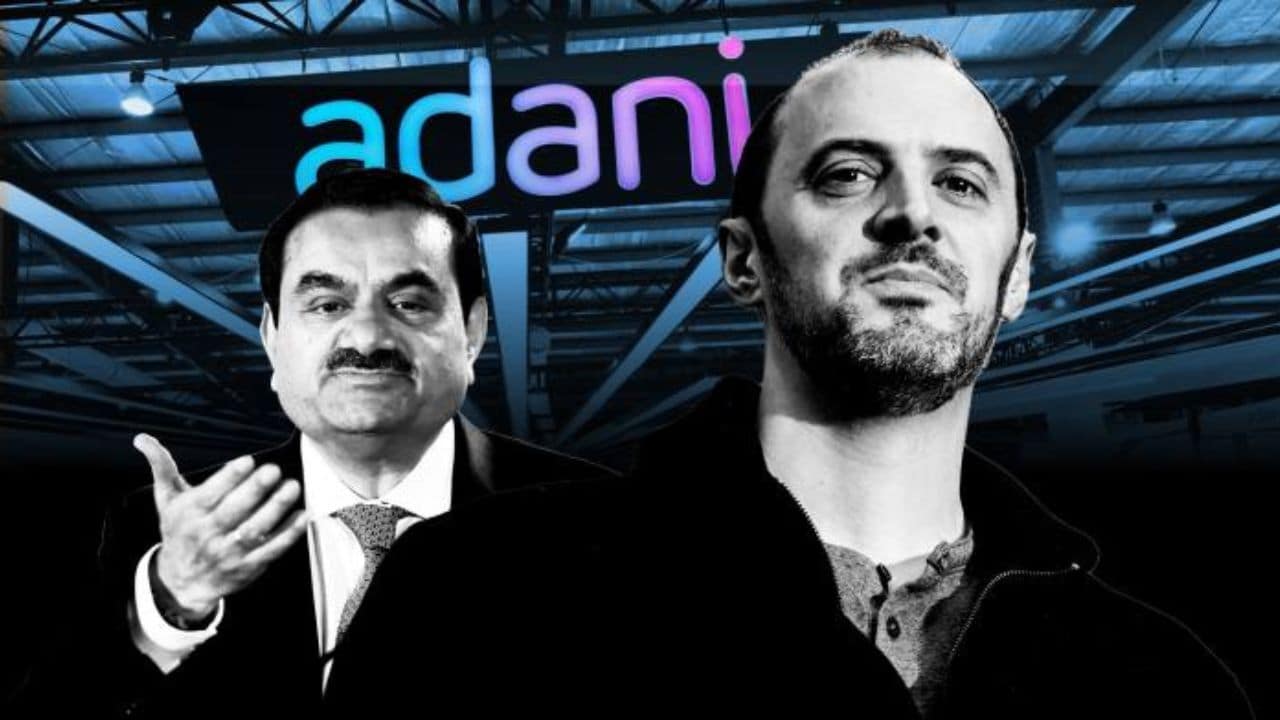

SEBI gives Adani Group, Gautam Adani clean chit on Hindenburg allegations

Published on 18/09/2025 08:49 PM

SEBI gives Adani Group, Gautam Adani clean chit on Hindenburg allegationsSEBI gives a clean chit to Gautam Adani, Rajesh Adani, and key Adani entities, dismissing Hindenburg’s allegations of insider trading and market manipulation.By Ajay Vaishnav September 18, 2025, 8:49:21 PM IST (Updated)3 Min ReadIndia’s markets regulator, the Securities and Exchange Board of India (SEBI), on Thursday, September 18, cleared billionaire Gautam Adani and his diversified conglomerate of allegations related to stock manipulation made by the US-based short-seller Hindenburg Research. SEBI’s investigation found no evidence that the diversified group used related parties to channel funds into its listed companies.

In two detailed orders, SEBI concluded that claims of insider trading, market manipulation and breaches of public shareholding norms were unsubstantiated following an extensive investigation.

Hindenburg, which has since ceased operations, published a damning report in January 2023 accusing the Adani Group of using three companies—Adicorp Enterprises Pvt Ltd, Milestone Tradelinks Pvt Ltd, and Rehvar Infrastructure Pvt Ltd—as conduits to transfer funds from various group firms to publicly listed entities Adani Power Ltd and Adani Enterprises Ltd.

However, SEBI board member Kamlesh C Varshney clarified in the orders that there was no breach of disclosure requirements, as the transactions between these three firms and other group companies did not qualify as related party dealings under the rules at the time.

SEBI also found no evidence of violations relating to substantial acquisition of securities or control that might mislead investors.

“After a thorough investigation, SEBI has concluded there is no basis to hold the Adani entities or their executives liable or to impose penalties,” said the orders.

The regulator’s clean chit comes after months of scrutiny and market speculation prompted by Hindenburg’s report, which triggered a sharp sell-off in Adani Group stocks and wiped out more than $50 billion in market value at its lowest point.

The Adani Group has consistently denied all allegations contained in the Hindenburg report, with its shares having largely recovered.

A Supreme Court-appointed expert committee had earlier reached a similar conclusion, finding no prima facie evidence of any wrongdoing.

Gautam Adani responds to SEBI clean chit

Billionaire industrialist Gautam Adani welcomed the SEBI decision to clear him and the Adani Group of allegations related to stock manipulation raised by US-based short-seller Hindenburg Research.

In a strong statement, Adani said those who spread “false narratives” based on the Hindenburg report owe the nation an apology. In a post on X (formerly Twitter), accompanied by the Indian national tricolour, Adani said the SEBI ruling “reaffirmed what his group has always maintained — that the Hindenburg claims were baseless.”

“After an exhaustive investigation, SEBI has reaffirmed what we have always maintained, that the Hindenburg claims were baseless. Transparency and integrity have always defined the Adani Group,” he said.

Addressing the fallout, Adani expressed sympathy for investors impacted by the report, saying, “We deeply feel the pain of the investors who lost money because of this fraudulent and motivated report. Those who spread false narratives owe the nation an apology.”

He concluded his message with a reaffirmation of his commitment to India’s growth and institutions: “Our commitment to India's institutions, to India's people and to nation building remains unwavering. Satyamev Jayate! JAI HIND!”

With inputs from agenciesContinue ReadingFirst Published: Sept 18, 2025 6:20 PM ISTCheck out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!Tagsadani groupSEBI